Latest scams & alerts.

To help better protect you, this page provides information on some of the scams that are circulating at the moment.

November 2025.

Bank Impersonations Targeting Business Customers

We're seeing increased scam activity in which Westpac business customers are receiving calls from scammers impersonating bank staff. The scammers are directing people to fake websites with a link to log-in directly to online banking in an attempt to steal confidential information.

What to look out for:

Please be cautious of any unexpected contact and only use verified Westpac digital banking channels such as Westpac One or Business Online accessed via our main website, or via the official Westpac One app.

How to avoid bank impersonations

- If you're ever unsure about a call from us or any other bank, hang up and call using a number listed on the public website.

- If you believe you have been contacted by a scammer and shared any information, please call us immediately, contact your Relationship Manager or visit your local branch.

Important security reminder:

Westpac will never ask for your login details – including your username and password – by email or phone.

We will never send direct links to log in to our online banking platforms via email or SMS.

July 2025.

Online Marketplace Scams

What’s happening?

Online marketplaces like Facebook Marketplace can be a great way to buy and sell things, but it's also a hotspot for scammers. Scammers pose as buyers and sellers to try and scam you out of money or the items you’re selling, or to get your personal or banking information.

If you’re buying

Buyers may be tricked into paying for a product that doesn't exist or is never delivered.

If you’re selling

Sellers may be tricked into believing the buyer has paid in full (they may send you a fake ‘proof of payment’), however you later find the money was not paid into your account.

Watch out for phishing links too. It’s common for scammers to pretend to arrange shipping and send a phishing link to steal banking information from you – never click on these links.

What to look out for:

- Recently set up buyer/seller profiles, poor feedback or limited friends or connections depending on the platform.

If you’re buying:

- Price is too good to be true: Be cautious if the item is being sold at an unusually low price.

- Suspicious product listings: Check if the product details or pictures have been copied from another site, which can indicate a scam.

- Pressure to complete sale: If a seller pressures you to complete the sale quickly, it’s a red flag.

- Signs that the seller is based overseas: For example, listing products in New Zealand but profile photos, details and friends list indicates the individual is based overseas.

If you’re selling:

- Buyer offering immediate payment: Be cautious if a buyer immediately offers to pay for a high-value item without viewing it first.

- Pressure to complete sale: Be wary if someone is asking you to release the goods before you’ve received payment. Screenshots showing proof of payment can be forged or altered. Look out for future dated payments that may be cancelled after the goods have been obtained.

How to avoid Online Marketplace Scams:

- Avoid trading if the other person’s profile has been recently set up, if they have bad feedback, or limited friends or connections depending on the platform.

- Be wary of any requests to complete trades or communicate off the platform or by means that aren't normal for that platform. For example, wanting to message on WhatsApp.

- Don’t click on links provided by buyers or sellers. Never share your online banking credentials/ password, card details or SMS one-time codes.

If you’re buying:

- Inspect goods in person: If possible, view the goods in person before completing the purchase to avoid any surprises.

- Unusual payment methods: Avoid payment methods like cryptocurrency, gift cards, postage payments, or overseas transactions.

- Mismatch of account names: Ensure that the account name matches the bank account details when making a payment.

- Deposit requests: Be wary if you're asked to pay a deposit to secure the item, especially if the seller claims there is high interest in the product.

If you’re selling:

- Payment proof: Always confirm that the funds are in your account before releasing the goods. Don’t rely on emails, texts, or screenshots as proof of payment.

- Phishing links: Don’t click on links provided by buyers to confirm postage, as these may be phishing attempts. Be wary of links claiming to be related to courier companies, banks or asking for credit card or online banking details.

April 2025.

Emails impersonating Westpac

We're receiving multiple reports of phishing emails impersonating Westpac. The campaign appears to be targeting Xtra email accounts and says that unusual activity has been detected on an account or that details need to be updated. It invites the user to click a link to secure or verify their account. These emails are phishing. The link should not be clicked and no details should be shared.

What should I do?

If you receive an email similar to this:

- Do not click on any links or download/open any attachments.

- Forward the email to phishing@westpac.co.nz

- Once reported, delete the email and block the sender.

- Please be extremely vigilant for any unexpected or suspicious emails, phone calls or text messages, particularly those that ask you to take urgent action.

- If you believe you've been targeted by a scam or have shared any details with a scam site, contact your bank immediately.

- If you think your personal details have been compromised, you can also contact ID Care on 0800 121 068 or 09 884 4440, 10am to 7pm, Monday to Friday.

Cryptocurrency scams

Scammers are using the increased public interest in cryptocurrency to create a sense of urgency and convince people to “invest” quickly without considering the risks.

They may also ask victims to purchase cryptocurrency when they’re carrying out a variety of scams including investment, relationship and employment scams - many of these start with an online advert or a social media post, DM or text message. Be careful as scammers may pose as account managers, brokers, financial advisors, mentors or recruiters.

Be cautious when dealing with crypto and make sure you do your research as it’s unlikely you’ll get your money back if it’s a scam. If you’ve been scammed, call us on 0800 400 600.

What to look out for

- Investment opportunities involving cryptocurrency.

- Investment opportunities that promise high or guaranteed returns.

- Being asked to purchase cryptocurrency online or use a cryptocurrency ATM.

- Being instructed to deposit into a cryptocurrency wallet you don’t control or haven’t set up yourself.

- Out of the blue contact about a job opportunity.

- Work-from-home opportunities advertised on social media.

- High paying jobs that have low hours and need no specialised skills or experience.

- Jobs that require you to invest your own money to earn income or use your personal bank accounts to process transactions.

- Being told to lie to your bank about the purpose of transactions.

- Celebrity endorsements (including political figures) for investments or cryptocurrencies.

- Offers to recover cryptocurrency lost in previous scams.

How to avoid cryptocurrency scams

- Always complete thorough, independent research on any cryptocurrency or investment opportunities.

- Visit the Financial Markets Authority website for information on the latest investment scams. The International Organization of Securities Commissions provides a consolidated list of many of the warnings issued by regulators globally.

- Avoid purchasing cryptocurrency if you don’t understand how it works and how to do so safely.

- If you are purchasing cryptocurrency, use well-known exchanges.

- Ensure that you have control over your cryptocurrency wallet (don’t allow others to set it up for you). Do not share your private key or seed phrase.

- Always be honest with your bank about the purpose of a transaction if it’s queried. We’re here to help you spot and avoid scams.

Find out more Keep cryptocurrency secure - Own Your Online.

October 2024.

Investment scams – celebrity endorsements and education

What’s happening?

We’re continuing to see a high number of investment scams and many of these scams start with an online advert or article, often on social media platforms.

These may come in the form of:

Fake celebrity or political endorsements.

False news stories with images or videos of popular New Zealanders, overseas celebrities or well-known political figures being interviewed about an investment opportunity, often stating that they’ve made large returns.

Free education, coaching or tips.

People are often encouraged to join group chats on social media platforms, which offer free education or tips on investment trading. These groups are led by a “mentor, “coach” “professor” or “assistant” who will recommend an investment platform.

Common themes:

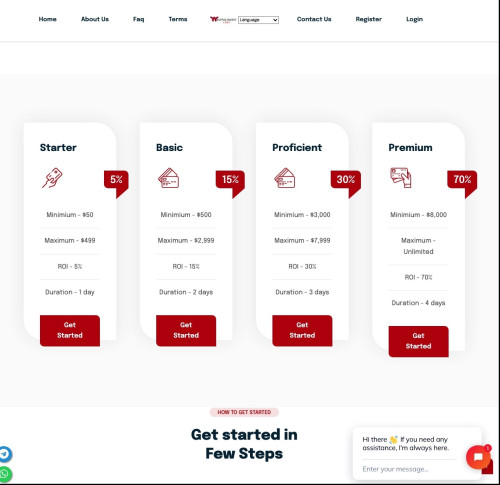

- There is usually a specific investment platform being promoted. Scammers put a lot of effort into making these platforms look legitimate

- The investment opportunity often involves cryptocurrency or a cryptocurrency trading platform

- There are promises of high returns

- Users may initially be able to withdraw funds but later, victims are told they must pay a fee to release the money (i.e. taxes, escrow services). Even if these fees are paid, no money is returned

- Websites include registration forms, where potential victims are prompted to enter their personal details. Following this, victims may be contacted by a broker, account manager or financial advisor to help them set up their accounts

- Articles are often made to look as though they’re being published by legitimate media organisations.

What should I do?

- If you come across these kinds of ads, don’t click on them and don't provide your personal information.

- Never respond to social media messages about investment opportunities.

- Seek advice from a qualified financial advisor if you’re thinking about investing.

- Make sure the entity you’re dealing with is registered to provide financial products and services to New Zealanders by checking the Financial Service Provider Register (FSPR).

- Check the FMA website for information on the latest investment scams.

If you believe you have been the victim of a scam:

- Contact your bank immediately

- Stop all contact with the scammers and don’t send any more money

- Report the ads or chat groups to the social media platform and block the scammers on all devices

- Be aware that you may also get contacted by people claiming they can help you recover these funds (these are known as recovery room scams)

- You can also contact ID Care for specialist aftercare support.

More information

Please see the following FMA warnings:

- Fake Celebrity Investment Scam – Multiple trading platforms

- Deepfake video scam warning: fake news stories, political endorsements - multiple trading platforms

- WhatsApp educational and investment platform scam

- Investment software packages and seminars

Brushing scams

What’s happening?

Have you received an unexpected parcel in the post, generally containing a low-value item and a QR code? Be cautious and make sure that you don’t fall victim to the latest scam to affect New Zealanders – ‘brushing’.

Brushing scams involve offenders sending out parcels containing unsolicited, often low value items with no (or limited) information on the sender; alongside the item will also be a QR code.

Offenders are relying on the lack of information contained within the parcel to encourage recipients to scan the QR codes to learn more about the package and sender. Instead, once the QR code is scanned the recipient is at risk, with the QR code generally directing them to a website that will attempt to compromise their personal and financial information through either phishing or malware.

Westpac is aware that some New Zealanders have received ‘brushing’ parcels, and urge you to be cautious with any unsolicited parcels, and unsolicited communication more broadly.

What should I do?

If you receive an unsolicited package similar to what is described above:

- Don’t scan the QR code included in the package

- Don’t try and find the sender’s website

- If you have scanned the QR code, contact your bank immediately

- If you think your personal details have been compromised, you can also contact ID Care on 0800 121 068 or 09 884 4440, 10am to 7pm, Monday to Friday.

New Zealand Police advises that you can either keep or dispose of the unsolicited item.

More information

For further information, please see the advisory issued by New Zealand Police on their Facebook page.

August 2024.

New Zealand Police impersonation scam

What’s happening?

We’re aware of a scam where offenders are impersonating New Zealand Police officers during phone calls, and ‘recruiting’ their victims to help with an investigation.

The victims receive a phone call and the caller will ‘identify’ themselves as a member of the New Zealand Police and provide a fake ID number.

The caller informs the victim that they are undertaking an investigation (often involving counterfeit currency or stolen credit cards) and request the victim’s assistance in their investigation. This assistance will involve either sharing their banking information or making a large cash withdrawal; in instances of cash withdrawals, the offenders will later visit the victim’s property to collect the cash.

What should I do?

If you receive a call from an individual claiming to be a New Zealand Police officer:

- Ask the caller to identify themselves, including their employee ID

- Disconnect the call and contact New Zealand Police's non-emergency line (105) to verify the caller

- Do not provide the caller with any personal information, including PINs or passwords

- Do not withdraw money if requested by the caller

- If you have received a call like this and have provided your personal or financial information to the caller, contact us immediately on 0800 400 600.

Remember, New Zealand Police will never call to ask for your banking details, including PINs and passwords, or to withdraw money.

More information

For more information, see the following advisory messages from New Zealand Police:

June 2024.

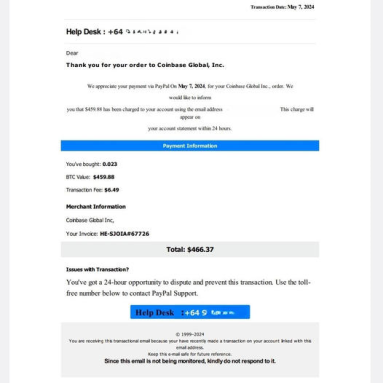

We're receiving multiple reports of phishing emails pretending to be from PayPal.

These emails don’t come from PayPal email addresses but they have display names like “Order Summary” or “Payment Info” to trick recipients.

The emails state that the recipient’s PayPal account has been used to purchase cryptocurrency - the example below cites Coinbase but Bitcoin is the cryptocurrency we're seeing most often.

The email says the customer's account will be charged within 24 hours if they don’t contact the ‘PayPal help desk’ on a provided number to dispute the charges.

When a customer calls the number provided in the email, they are instructed to take actions which can result in fraud, including:

- Install software and/or provide remote access to their device(s)

- Log in to their digital banking

- Share their two-factor authentication codes from password resets and/or payments

- Transfer funds to a third party to “keep the money safe” or “catch hackers”.

What should I do?

If you receive an email similar to this:

- Do not contact the phone number on the email

- Do not click on any links or download/open any attachments

- Forward the email to phishing@westpac.co.nz

- Once reported, delete the email and block the sender

- Contact Paypal through their verified channels to confirm any contact is legitimate

- Please be extremely vigilant for any unexpected or suspicious emails, phone calls or text messages, particularly those that ask you to take urgent action

- If you believe you've been targeted by a scam, contact your bank immediately

- If you think your personal details have been compromised, you can also contact ID Care on 0800 121 068 or 09 884 4440, 10am to 7pm, Monday to Friday.

May 2024.

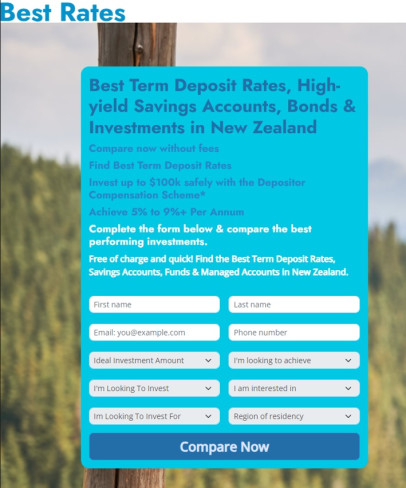

Our Financial Crime team is warning of a fraudulent term deposit scheme that imitates Kiwibank branding and has led to some very large losses lately.

Similar to the Ratesfinder website scam the FMA warned of last year, customers are being contacted after putting details into term deposit comparison websites like Ratesfinder or nzbestrates247 (as pictured).

Customers are then sent highly professional-looking disclosure statements featuring Kiwibank branding and even the FMA logo. Kiwibank have confirmed these are not their documents.

Investments made through this scheme are stolen.

What should I do?

- Seek advice from a qualified financial advisor if you’re thinking about investing. Online searches can lead you to fraudulent websites and/or adverts

- Contact the relevant financial product provider through verified channels for confirmation before investing any money

- Do not use contact information – phone numbers, email addresses or websites supplied by the person offering the investment

- Avoid engaging with online ads and online brokers or businesses with no presence in New Zealand

- Don’t respond to unsolicited investment offers

- Take time to consider what you have been asked to do and whether there's anything unusual about this opportunity. For example, being asked to send funds overseas or by unusual payment methods such as cryptocurrency

- If you ever think you’ve been scammed, call us immediately on 0800 400 600.

April 2024.

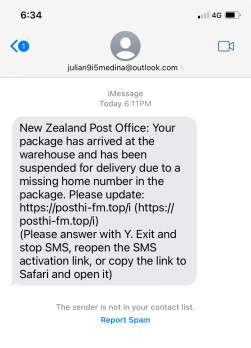

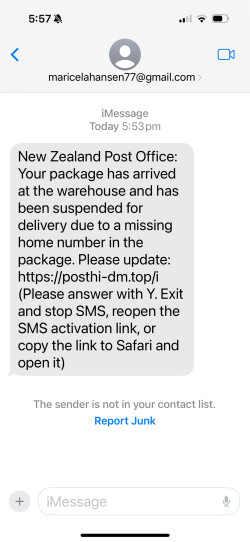

NZ Post phishing scam

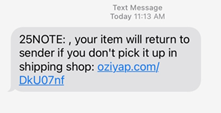

Parcel delivery text phishing scams continue. The latest message pretending to be from New Zealand Post says that a package has arrived at their warehouse and has been suspended for delivery due to a missing home number.

The message asks recipients to respond and follow a link provided. These links direct people to malicious sites that will either infect their device or obtain personal details to compromise their bank accounts.

These messages are coming from email addresses rather than phone numbers.

What to do

- If you receive a text message like this, do not respond or follow any links. The sender and the brand may vary but the intent of the message is the same.

- Send a screenshot of the message to phishing@westpac.co.nz.

- Forward the message to the DIA on 7726. The DIA will reply asking for the phone number/ email address the SMS was sent from – send that in a reply. For more information, see the DIA website.

- Once reported, delete the message and block the sender.

- Please be extremely vigilant for any unexpected or suspicious phone calls or text messages.

- Read carefully to understand what is being asked for.

- If you believe you've been targeted by a scam, contact your bank immediately.

- If you think your personal details have been compromised, you can also contact ID Care on 0800 121 068 or 09 884 4440, 10am to 7pm, Monday to Friday.

February 2024.

Investment scams

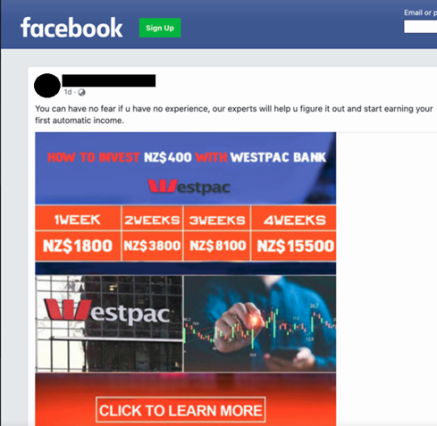

There continue to be sophisticated investment scams using the branding of banks and other financial institutions. These scams can result in large financial losses and in many cases the money can’t be recovered.

Below is an example of a fake Westpac website that scammers set up. They’re pretending to offer investment options to steal people’s money.

What to do?

- You can visit our Kiwisaver and Investments page to find out about the investment options we offer.

- Before investing, contact the bank or financial institution using contact details on their official website to confirm any offers are genuine.

- Seek advice from a qualified financial advisor. Online searches can lead you to fraudulent websites and adverts.

- Avoid engaging with online ads and online brokers or businesses with no presence in New Zealand.

- Take time to consider what you have been asked to do and whether there's anything unusual about the offer.

- Visit our types of scams page to learn more about investment scams and how to avoid them.

- If you think you’ve been scammed, call us immediately on 0800 400 600.

Fake Westpac calls

We are continuing to see a high volume of scam calls to Westpac customers. Scammers are posing as Westpac employees and calling customers pretending to be from Westpac, often our Financial Crime or Fraud team. They may say there’s been fraud on your account and that quick action is needed to secure the funds. But the calls aren’t from us.

Through the phone call, scammers are trying to gain information needed to access customers’ bank accounts or convince customers to make payments. The scammers gain information about people and their banking (often from phishing) prior to the call and use this to trick customers into believing they are genuine Westpac employees.

Some of these calls appear to come from official Westpac phone numbers (or numbers that look similar). They can also come from other domestic or international numbers (often Australia or UK).

What to do:

- Please be extremely vigilant for any unexpected or suspicious phone calls. If you have any doubt, phone us yourself using our official phone number, 0800 400 600.

- If you're calling us after a suspicious phone call, always wait on the phone until we answer, don’t request our call back service. Scammers often call again, and you may think it’s us, but it could be the scammer.

- Don't feel pressured to comply with a request you're not comfortable with. Scammers often spend a long time convincing people to do what they want and may call them repeatedly.

- Carefully read any email and text alerts you receive from us and make sure that you are using that information for its intended purpose only.

- If you believe you've been targeted by a scam, contact us immediately.

- You can also block your Credit or Debit Mastercards through the 'Manage my Cards' button in Westpac One® digital banking.

Westpac staff will never ask you for the following:

- We'll never ask you to give us remote access to your computer or phone, or to download software like Anydesk or Team Viewer.

- We'll never ask you to move money to another account to keep it safe or help us catch criminals or hackers.

- We'll never come to your home (or send a courier) to pick up cards or cash.

- We'll never ask you to withdraw cash to keep it safe.

- Under no circumstances would anyone from Westpac ask for your digital banking password or PIN. These are your details and shouldn't be shared with anyone.

- We'll never email or text you with a direct link to a page asking you to log into your digital banking or provide any personal information.

- We'll never send you an unsolicited message on social media or messaging apps like Whatsapp.

December 2023.

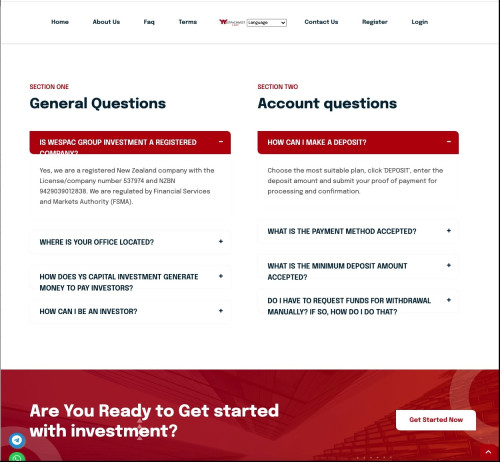

New Westpac branded phishing trend

Westpac impersonation ‘phishing’ campaigns are continuing – below is a recent example in an email.

What to do:

Be extremely wary of any emails or text messages claiming to be from Westpac, and never follow a link claiming to take you to log into your Westpac account.

October 2023.

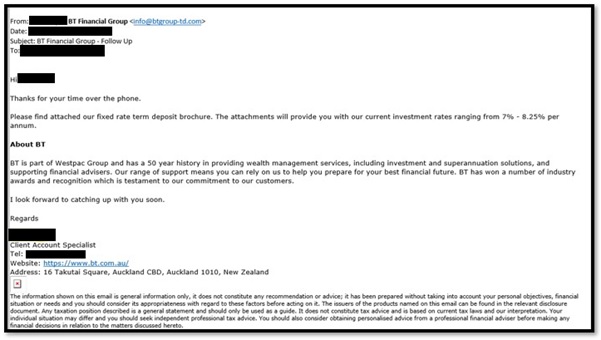

BT themed investment scams

We’re getting a high number of reports of investment scams using branding of well-known financial institutions. Recently, scammers have set up fake BT Financial websites and are sending fraudulent emails claiming to be from BT.

The websites and emails look and sound professional. Once people have registered or expressed interest, they are provided with legitimate looking application forms, prospectus documents and/or other brochures.

They will be asked to provide personal information (including IDs) and to transfer funds. These scams can result in huge financial loss and in many cases the funds are unrecoverable.

What to do:

- BT Funds Management (NZ) Limited (BTNZ) manages all of Westpac's investment funds. You can contact us on 0508 972 254 or from overseas +64 9 375 9978 to confirm whether an investment is legitimate.

- Seek advice from a qualified financial advisor if you’re thinking about investing. Online searches can lead you to fraudulent websites and/or adverts.

- Avoid engaging with online ads and online brokers or businesses with no presence in New Zealand.

- Don’t respond to unsolicited investment offers.

- Take time to consider what you have been asked to do and whether there's anything unusual about this opportunity. For example, being asked to send funds overseas or by unusual payment methods such as cryptocurrency.

- Set up security alerts on Westpac One to keep track of online activity.

- If you ever think you’ve been scammed, call us immediately on 0800 400 600.

September 2023.

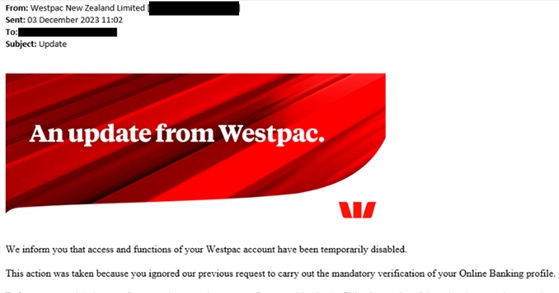

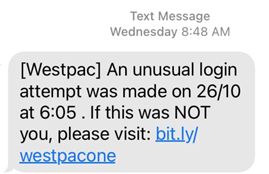

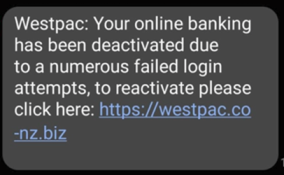

Westpac themed phishing texts

Our Financial Crime team continue to receive reports of phishing texts pretending to be from Westpac.

These messages direct people to malicious websites designed to look like the bank’s real website or advise the recipient to call a number. These sites either infect devices with malware, collect the victim's personal and banking details, or both. Interacting with these text messages can lead to bank impersonation calls and scam attempts.

What to do:

- If you receive a message like this, don’t click on any links or call the number.

- Send a screenshot of the message to phishing@westpac.co.nz

- Forward the message to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website.

- Once reported, delete the message and block the sender.

- If you believe you've been targeted by a scam, contact your bank immediately.

- Please be extremely vigilant for any unexpected or suspicious phone calls or text messages.

- Listen/ read carefully to understand what is being asked for.

- If they claim to be from Westpac, hang up and call us back on 0800 400 600.

- When phoning, don’t request a call back as scammers often call again.

- Never allow remote access to your devices or download software at the request of a caller.

- Never share your digital banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

July 2023.

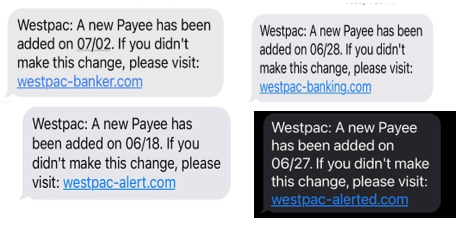

Westpac themed phishing texts: new payee added

Our Financial Crime team has received numerous reports of a new Westpac branded phishing text advising that a new payee has been added. The text messages are coming from New Zealand mobile numbers.

These messages direct people to malicious websites designed to look like the bank’s real website. These sites either infect devices with malware, collect the victim's personal and banking details, or both. Interacting with this text message has led to bank impersonation calls and scam attempts.

What to do:

- If you receive a message like this, don’t click on any links.

- Send a screenshot of the message to phishing@westpac.co.nz

- Forward the message to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website.

- Once reported, delete the message and block the sender.

- If you believe you've been targeted by a scam, contact your bank immediately.

- Please be extremely vigilant for any unexpected or suspicious phone calls or text messages.

- Listen/ read carefully to understand what is being asked for.

- If they claim to be from Westpac, hang up and call us back on 0800 400 600.

- When phoning, don’t request a call back as scammers often call again.

- Never allow remote access to your devices or download software at the request of a caller.

- Never share your digital banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

June 2023.

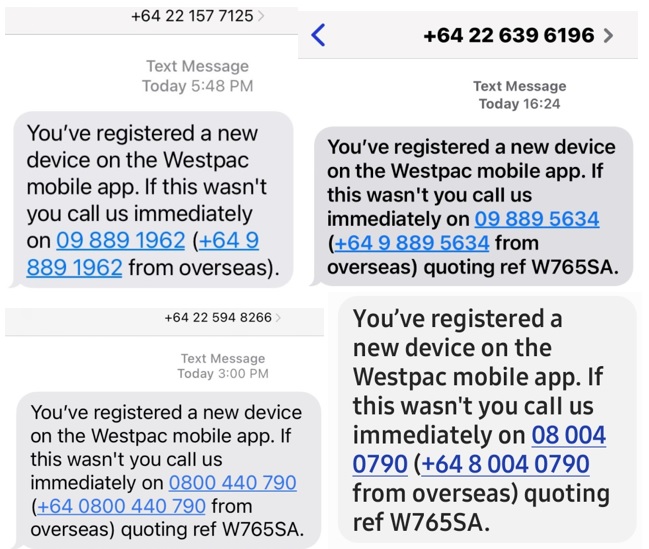

Westpac themed phishing texts

Our Financial Crime team has received numerous reports of a widespread text phishing campaign.

The messages say ‘You have registered a new device on the Westpac mobile app. If this wasn’t you call us immediately’ with a landline or an 0800 number.

This type of phishing is different as it does not include a URL link to click on and is asking people to call ‘Westpac’ on a New Zealand based number. If people were to call these numbers, they will likely get an individual impersonating Westpac staff, trying to obtain information or authentication codes in an attempt to access their accounts.

The text messages are coming from New Zealand mobile numbers. The sender and the numbers provided to call vary but the intent of the message is the same.

What to do:

- Forward phishing emails and SMS messages to phishing@westpac.co.nz

- Forward phishing SMS messages to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website

- Once reported, delete the message and block the sender

- If you believe you've been targeted by a scam, contact your bank immediately

BT themed investment scams

We’re getting a high number of reports of investment scams using branding of well known financial institutions. Recently, scammers have set up fake BT Financial websites and are sending fraudulent emails claiming to be from BT.

The websites and emails look and sound professional. Once people have registered or expressed interest, they are provided with legitimate looking application forms and brochures.

They will be asked to provide personal information (including IDs) and to transfer funds. These scams can result in huge financial loss and in many cases the funds are unrecoverable.

What to do:

- BT Funds Management (NZ) Limited (BTNZ) manages all of Westpac's investment funds. You can contact us on 0508 972 254 or from overseas +64 9 375 9978 to confirm whether an investment is legitimate.

- Seek advice from a qualified financial advisor if you’re thinking about investing. Online searches can lead you to fraudulent websites and/or adverts.

- Avoid engaging with online ads and online brokers or businesses with no presence in New Zealand.

- Don’t respond to unsolicited investment offers.

- Take time to consider what you have been asked to do and whether there's anything unusual about this opportunity. For example, being asked to send funds overseas or by unusual payment methods such as cryptocurrency.

- Set up security alerts on Westpac One to keep track of online activity.

- If you ever think you’ve been scammed, call us immediately on 0800 400 600.

See more information about investment scams.

May 2023.

Investment scams

Investment scams are on the rise. Many start with a cold call, an online ad or a message on social media. Scam websites can also show up when you search for investment opportunities online. This will lead to someone contacting you claiming to be a broker or account manager who’s eager to help you invest. Later, when you try to withdraw your investment you find you can’t and may even be asked to pay more to access your funds.

These scams can result in huge financial loss and in many cases the funds are unrecoverable. Watch out for scams involving cryptocurrency and fake term deposits or bonds from scammers pretending to be from legitimate financial service providers (such as banks).

What to do:

- Contact the financial institution offering the investment using a number on their official website to check it’s legitimate

- Consider if there’s anything suspicious about what they’re offering – they often promise a high return for what seems like low risk

- Seek advice from a qualified financial advisor

- Don’t respond to unsolicited investment offers

- If you ever think you’ve been scammed, call us immediately on 0800 400 600.

Sextortion

Sextortion involves scammers reaching out and forming relationships with people on social media platforms like Snapchat, Discord or Wizz and later moving the conversation onto other platforms that display friends and family profile details.

Scammers use specific profiles so they appear to be around the same age as the victim and of the opposite sex. They often begin by reaching out for a friend request and then move the conversation to a platform such as Instagram where they can view the victim’s contacts.

They then send the victim an intimate image and encourage them to take part in video chats or sharing their own intimate pictures. Screenshots are taken of intimate images and videos are recorded.

As soon as an intimate image or video has been shared the victim is told they have been recorded and that the recording or pictures will be shared online or with their friends and family unless a ransom is paid immediately.

The scammers apply pressure to the victim and tell them the image will be deleted as soon as they pay. However, this is not the case. They will keep demanding more money.

What to do:

- Cease all contact with the scammer. Save or screenshot any online chats for evidence, then block the scammer’s profile.

- Don’t pay them or share any more images.

- Contact the correct authorities – by reporting to a local police station or online 105 Police Non-Emergency or to Netsafe

- If you have a copy of the private images or video you are being threatened with, you can use a free service to get them removed.

- Images or videos of people under 18 years of age: Take It Down

- Images or videos of people aged 18 and over: Stop NCII

- It might be a good idea to deactivate social media profiles for a while or set social media account privacy settings to their highest level.

- For confidential support, victims can talk to:

For more information, see our REDnews article Sextortion: The damaging new scam targeting teenagers.

Threat and penalty scams

Scammers are contacting people and claiming to be from Police, another government agency or business and using threats to get money and personal information. Recently they have been posing as employees from the Chinese Embassy and/or Chinese or Hong Kong Police.

Usually, they accuse people of a crime or of having unpaid fines or fees and demand a payment. They’ll threaten arrest, visa cancellation or deportation if the victim doesn’t comply.

Scammers even dress up in police uniforms and provide fake arrest warrants or other documents to convince people.

What to do:

- Be wary of threatening calls, messages or emails. Police will never contact you this way and ask you to send money.

- Contact the organisation using the contact details on their official website to confirm whether a request is genuine.

- Don’t feel pressured to comply with a request urgently. Any genuine business or government agency will give you time to pay invoices, bills or fees.

- Always be honest about what happened with your bank so that we can assist you and help keep your money safe.

April 2023.

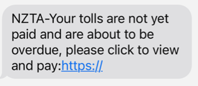

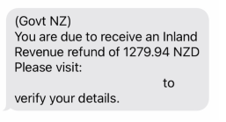

NZTA / Toll phishing SMS and emails

Our Financial Crime team are seeing a significant phishing campaign, involving both SMS and email messages.

The most reported varieties impersonate the NZTA and claim the user needs to pay tolls or renew their vehicle registration. Other messages impersonating IRD or other government departments are also being sent.

These messages direct people to malicious websites designed to look like the real government website. These sites either infect devices with malware, collect victim's personal and banking details, or both.

The scammers then compromise the victim's accounts and conduct fraudulent transactions. This type of phishing is not new, but the current campaign is more extensive than we have seen recently.

What to do:

- Do not click on or open any links in SMS or emails unless you are completely certain that both the sender and the link are legitimate. If you are unsure, do not open the link

- If you have recently travelled on toll roads, visit the legitimate NZTA website to pay your toll

- Forward phishing emails and SMS messages to phishing@westpac.co.nz

- Forward phishing SMS messages to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website

- Delete the message and block the sender

- If you believe you've been targeted by a scam, contact your bank immediately.

February 2023.

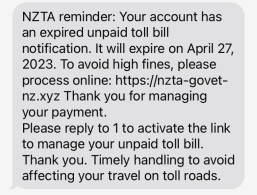

Phishing emails

Our Financial Crime team are seeing multiple instances of Westpac branded phishing emails informing people that their accounts have been disabled. These are scam emails and embedded links go to fake websites used to steal customers' personal and banking information.

What to do:

- If your receive an email like this, don’t click on any links, respond or call any numbers provided on the email.

- Send it to phishing@westpac.co.nz and delete it.

- Always log in to digital banking through the official website or app. We won’t ask you to click on links in texts or emails to log into online banking, provide login details, passwords, PINs or any personal information.

- Please be extremely vigilant for any unexpected or suspicious emails, phone calls or text messages.

- Never share your digital banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

- If you believe you've been targeted by a scam, contact your bank immediately.

Fake Westpac calls

Our Financial Crime team have had reports of customers receiving calls from scammers posing as Westpac employees.

Some of the calls appear to come from an official Westpac phone number, however the calls are not from Westpac. Through the phone call, scammers are trying to gain information needed to access the customers’ bank accounts.

What to do:

- Please be extremely vigilant for any unexpected or suspicious phone calls.

- Listen carefully to what is being asked for.

- If in doubt, end the call.

- If they claimed to be from Westpac, call us back on 0800 400 600.

- When phoning, don’t request a call back as scammers often call again.

- Never allow remote access to your devices or download software at the request of a caller.

- Never share your digital banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

- If you believe you've been targeted by a scam, contact your bank immediately.

Flood-related scams

Scammers take advantage of current events to steal money and bank details. Our Financial Crime team expect to see flood-related scams in the next few days so please be wary of requests for your money or details.

What to do:

- Avoid clicking on links in emails or text messages unless you can confirm they are genuine – Westpac will not ask you to click on links to resolve issues with your accounts.

- Be vigilant for any unsolicited or unusual calls, texts or emails from your bank, insurance company or another business or government agency.

- If you receive a call that you are unsure about, hang up and call the organisation back on their official number.

- Only use well-established and reputable fundraising platforms or official charities to make donations.

January 2023

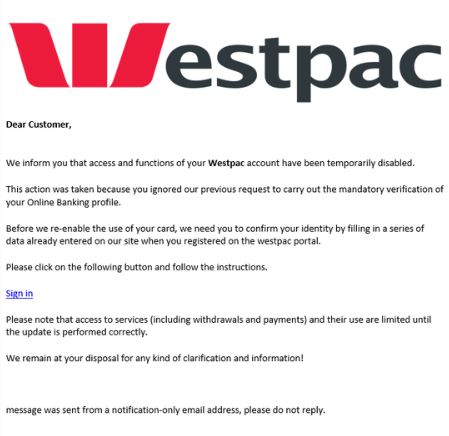

Phishing texts

Our Financial Crime teams are seeing multiple instances of a new Westpac branded phishing text that reads:

"Westpac Notification. Card ending in XXXX has a transaction at 'MOONPAY' for $0.00 at 6:27. If you do not recognise this, reply 'No' to have a Westpac agent contact you. No response is required if you recognize the transaction."

Interacting with this text message leads to a bank impersonation call and scam attempts.

December 2022.

Christmas scams

Scammers love Christmas. You may be asked to pay for online goods that are never delivered. Sellers are also being duped with payments that never arrive.

A lot of parcel delivery phishing happens over Christmas. It starts with a false parcel text. Inside is a link to track the delivery, or to pay a fee. But the link leads to a site designed to steal credit card details or install viruses.

Investment scam

We’ve been alerted to a Facebook ad that uses our name and branding to advertise massive returns on small investments. This is a scam – please do not click any links or interact with the account. Remember – if it looks too good to be true, it probably is.

November 2022.

Parcel delivery phishing

Parcel delivery text phishing scams continue. The text contains information about a parcel that is out for delivery or a delivery that has been missed. The text contains a web link to track or reschedule the delivery. Clicking the link will lead to a site designed to steal credit card details or install viruses.

October 2022.

Phishing texts

Our Financial Crime team continues to receive reports of phishing texts claiming to be from Westpac. The embedded links go to fake websites, used to steal customers' credit card details and online banking credentials.

August 2022.

Fake Westpac calls

The Financial Crime team have had reports of customers receiving calls from scammers posing as Westpac employees. Some of the calls appear to come from an official Westpac phone number, however the calls are not from Westpac.

Through the phone call, scammers are trying to gain information needed to access the victim’s bank accounts.

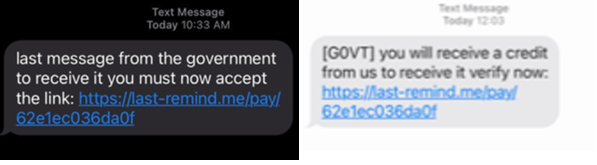

Cost of Living Payment scams

Our Fraud team is seeing several examples of text message scams based on the Government's Cost of Living payment. Embedded web links are used to steal personal information and banking credentials.

July 2022.

Phishing texts

The Financial Crime team have had reports of phishing texts stating that online banking has been deactivated. The embedded web link goes to a fake website, used to steal customers’ credit card details and online banking credentials.

Cryptocurrency scams

We've seen an increase in cryptocurrency investment scams. Scammers will often try and convince someone to pay large amounts to "invest" with the promise of high returns. They’ll often pitch these fake investment opportunities as being low risk as well. The victim may not know that they’ve been targeted by a scam until some time has passed, for example when they try to withdraw their funds.

Scammers will often claim to be financial advisors or investment experts, or claim to have made large profits investing in the scheme themselves. They may even create legitimate looking fake websites and prospectus documents or use celebrities' names and pictures to endorse their schemes.

May 2022.

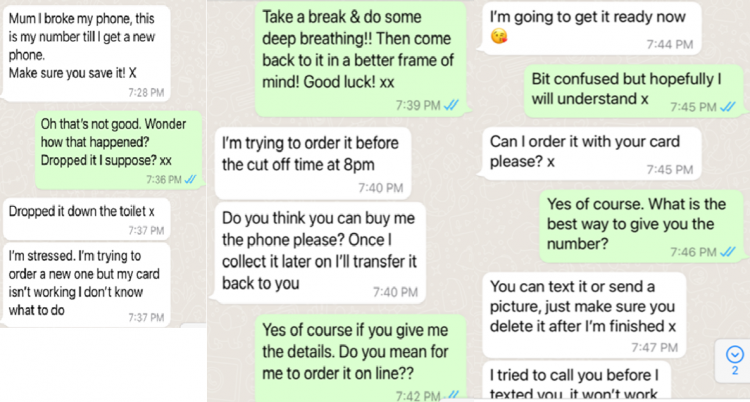

WhatsApp scam messages

We've received several reports of WhatsApp scam messages. The messages are targeting parents. The scammer, who is pretending to be their child, claims they have recently lost or damaged their phone and is messaging from a new phone number. They ask for help buying a new phone by requesting credit card details.

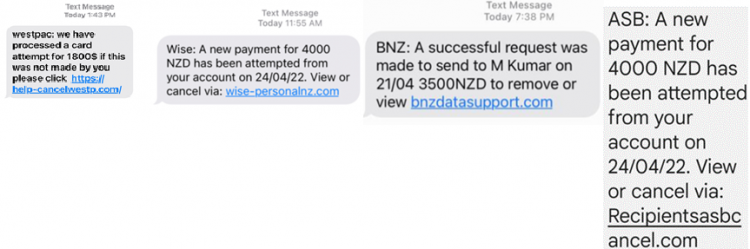

April 2022.

Phishing texts

The Financial Crime team have had reports of similar phishing texts relating to Wise, BNZ and ASB. The embedded web link goes to a fake website, used to steal customers' credit card details and online banking credentials. The texts are coming from different Australian mobile numbers.

January 2022.

Threat and penalty scams

The Financial Crime team are observing an increase in threat and penalty scams. Scammers are contacting people and claiming to be from the Police, another government agency, or a business, and threatening to take severe action or fine them unless they make payments or give out personal information.

There have been recent reports of scammers making contact by video call, posing as police officers in China and accusing the recipient of a crime. They threaten them with harm, arrest or legal action if they don't make payments to an overseas account.

Special deals

The Financial Crime team have identified several card compromises that appear to be linked to special deals being advertised on Facebook. Customers are responding to online ads offering these items for really low prices (e.g. $3 for a Smeg kettle, $2.99 for an iPad). Often they're asked to complete a survey and will be asked for personal and/or credit card details.

Scam calls targeting law firms

The Financial Crime team are aware of scam calls targeting law firms. The caller contacts the law firm claiming to be a Westpac staff member from the International Payments team and requests to speak with the firm’s bank account signatory. They claim funds have been fraudulently withdrawn from the firm’s account and that a block has been placed on the account. They ask the signatory to sign some forms to enable the block to be removed and the fraudulent payment to be reversed.

Westpac investment scam

We are aware of a sophisticated investment scam targeting customers which includes a fake Westpac Investment Prospectus.

Customers may find themselves targeted by these scammers when they do an internet search for term deposits or investments, and then click on fraudulent ad links that appear in the search results.

Report a scam.

Talk to us

If you believe you've been targeted by a scam, or any kind of fraud, contact us immediately. From overseas call +64 9 912 8000.

Email us

If you’ve received a suspicious email forward it to our dedicated phishing inbox.

Report to other agencies

Once you have spoken to us, you should report scams to other agencies so that they can take steps to prevent other people being targeted by them and losing money.

- Report fraud and scams to New Zealand Police

- Report online fraud and scams to Netsafe

- Report cybersecurity issues to CERT NZ

- Report investment scams to The Financial Markets Authority

- If you've been impacted by a scam or fraud, IDCARE provide specialist aftercare support.