Sustainable investment.

What we exclude and our sustainable themes.

Responsible Investment Leader 2022, 2023 and 2024.

BT Funds Management (NZ) Limited is the investment arm of Westpac in New Zealand.

We are proud to be recognised as one of New Zealand's Responsible Investment Leaders for 2022, 2023 and 2024 by the Responsible Investment Association Australasia (RIAA), giving you confidence that your investments are working towards building a more sustainable tomorrow.

As one of New Zealand’s largest fund managers, we recognise the role we play and the responsibility we have to drive sustainable value for our customers, people, communities and environment. We believe investing sustainably helps us achieve this vision and manage investment risk and opportunities. See how we’re progressing on our sustainable investment commitments in our 2023 BTNZ Sustainable Investment Report.

RIAA has certified our Westpac KiwiSaver Scheme funds and Westpac Active Series funds that are open for investment, except for the Westpac KiwiSaver Scheme Cash Fund1. They have been certified by RIAA according to the operational and disclosure practices required under the Responsible Investment Certification Program2. This will give you the confidence your investments are working towards a more sustainable tomorrow. See responsiblereturns.com.au for more details.

How we invest sustainably.

Our approach to sustainable investing has four guiding pillars:

- Exclusions

- Environmental, Social and Governance (ESG) integration

- Stewardship

- Sustainable themes

Our exclusions.

Our policy is to exclude companies or other issuers4,3 that are identified as operating outside of our sustainable investing criteria by our ESG research provider(s). We also exclude countries that we identify as operating outside our sustainable investment criteria.

About our exclusions.

We primarily rely on advice from our ESG research provider(s) for exclusion criteria, standards, and assessments. Where appropriate, we may utilise other information sources and/or our own assessments. Our country exclusion framework relies on publicly available reports and data sources. Exclusions criteria are applied where we hold securities directly. In the rare instance where we use third-party funds or exchange traded funds, we aim to align our exclusions as closely as possible to our Sustainable Investment Policy and at a minimum apply our fossil fuel, tobacco and weapons exclusions. For derivative based investments, the reference index for the derivatives contract may include exposure to excluded securities and, where possible, we will seek to choose contracts which incorporate our exclusions.

Implementation of this exclusion criteria can be affected by the accessibility and accuracy of data, or an error by an external service provider or investment manager. This may result in inadvertent holdings in investments we are seeking to exclude. In this event, as soon as this has been identified, the investment manager is required to divest within ten business days.

For details on how we manage our exclusions please refer to our full Sustainable Investment Policy.

ESG Integration.

We consider environmental, social and governance (ESG) factors before we decide to invest in a company or other issuer4, and again in our regular reviews of that investment. We believe that sustainable businesses are more likely to thrive in the long term and achieve better outcomes for everyone. We believes investing sustainably is a powerful way to achieve results both on and off the balance sheet.

Our investment managers are assessed and monitored on their commitment to sustainability.

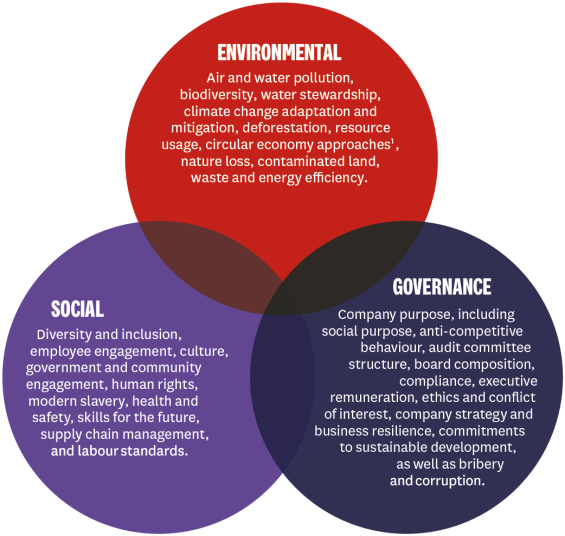

Example of key ESG factors that can be considered:

1 A circular (as opposed to linear) economy is one in which resources are built to be returned into new products and by-products are used to generate other products.

Stewardship.

Stewardship is the responsible management of our customers’ long-term investments as well as using our influence to maximise overall long-term value.

We believe that stewardship helps promote higher standards of corporate governance, which contributes to sustainable value creation, addresses climate change, reduces risks and increases the long-term return to our customers.

Stewardship is undertaken by both BTNZ and our underling investment managers. It includes engaging with companies we invest in, to make sure they align with our sustainable expectations, our sustainable themes, and voting at their shareholder meetings accordingly. Voting is generally undertaken by our investment managers, who exercise our voting rights on our behalf.

Another aspect of stewardship is collaboration with industry members to drive and influence systemic change.

Sustainable themes.

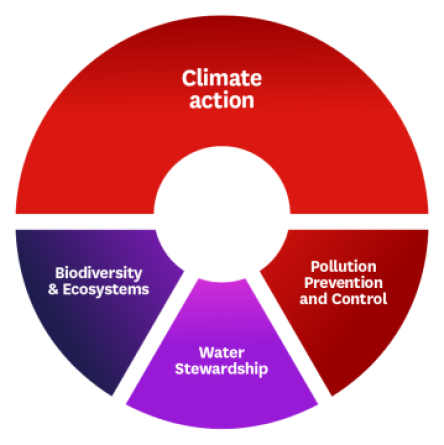

We believe climate change, ecosystem destruction, and biodiversity loss are some of the most significant issues to impact our environment – and our economy.

We are working to align our investments with the environmental objectives outlined in the European Sustainable Investment Taxonomy regulation3. This regulation is recognised, in the absence of a global sustainable standard, as the most comprehensive and respected approach.

Climate statements.

Note: BTNZ, as manager of the Westpac Premium Investment Funds Scheme, has not prepared or lodged a climate statement for the reporting period ended 31 March 2024, as the Scheme was closed on 30 November 2023.

We are proud members of, or a signatory to:

- Principles for Responsible Investment

- Responsible Investment Association Australasia (RIAA)

- Investor Group on Climate Change

- Net Zero Asset Managers initiative8

- Climate Action 100+

- Toitū Tahua Centre for Sustainable Finance

- Aotearoa New Zealand Stewardship Code

- RIAA Aotearoa Collaborative Working Group

Things you should know.

1 This excludes the Westpac Active Series Income Strategies Trust which is closed to new investment.

2 The Responsible Investment Certification Program does not constitute financial product advice. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Appropriate professional advice should be sought prior to making an investment decision. RIAA does not hold a Financial Advice Provider licence.

3 As the EU Sustainable Investment Taxonomy is not yet fully implemented (in particular, for biodiversity and ecosystems, pollution prevention and control and water stewardship) access to reliable and accurate data is limited and maturity by asset classes varies. We expect data to improve over the next 12 to 24 months. In the interim we rely on our investment managers to report using their own frameworks where possible. EUR-Lex - 32020R0852 - EN - EUR-Lex (europa.eu)

4 Where we refer to companies or issuers within this pillar, we mean entities which issue shares and/or debt, including corporate-like issuers (e.g. development banks) and government entities. This excludes asset-backed securities. The coverage of government related entities is limited (e.g. municipalities).

5 As determined by the Global Industry Classification Standard (GICS).

6 For the avoidance of doubt, this exclusion does not apply to the extraction of coking coal, which is used in steel production.

7 When determining to no longer invest in a particular company or issuer, we assess these factors together with the likely long-term impact of the exclusion on investment performance and portfolio risk.

8 The Net Zero Asset Managers initiative has suspended its activities as it undertakes a review of the initiative in light of recent industry developments.

All our managed funds, including the Westpac KiwiSaver Scheme, Westpac Active Series, Westpac Retirement Plan and Westpac Premium Investment Funds are managed under our Sustainable Investment Policy.

BT Funds Management (NZ) Limited (BTNZ) is the scheme provider and issuer, and Westpac New Zealand Limited is a distributor of, the managed investment schemes referred to above, including the Westpac KiwiSaver Scheme. You can get a copy of any applicable Product Disclosure Statement for these investments from any Westpac branch in New Zealand or download here:

The information above is subject to changes to government policy and law, and changes to the applicable managed investment scheme, from time to time. Investments do not represent bank deposits or other liabilities of Westpac Banking Corporation ABN 33 007 457 141, Westpac New Zealand Limited or other members of the Westpac Group of companies. They are subject to investment and other risks, including possible delays in payment of withdrawal amounts in some circumstances, and loss of investment value, including principal invested. None of BTNZ (as manager), any member of the Westpac group of companies, The New Zealand Guardian Trust Company Limited (as supervisor), or any director or nominee of any of those entities, or any other person guarantees any scheme's performance, returns or repayment of capital.