Westpac NZ is cutting all its fixed special home loan rates, giving it the joint lowest advertised rates of the five major banks on terms from 6 month to 3 years, and the outright lowest on its 4-and-5-year terms.

It’s the fourth time Westpac has cut its fixed rates since the start of July. On Wednesday it also passed on the official cash rate reduction to some floating home loan, business lending and savings customers.

The bank is also lowering some of its term deposit rates. All changes are effective Monday 19 August.

Westpac NZ General Manager of Product, Sustainability and Marketing Sarah Hearn says the bank continues to look for opportunities to pass on wholesale rate drops to customers in a highly-competitive market.

“Today’s changes mean our popular 1-year advertised special home loan rate has fallen by 0.55% p.a. over the past six weeks, delivering real savings to many homeowners,” Ms Hearn says.

“At the same time, we know some savings customers will be watching falling interest rates closely.

“We strongly encourage customers, whether borrowers or savers, to contact their bank as soon as they can, if they have any worries about their finances.”

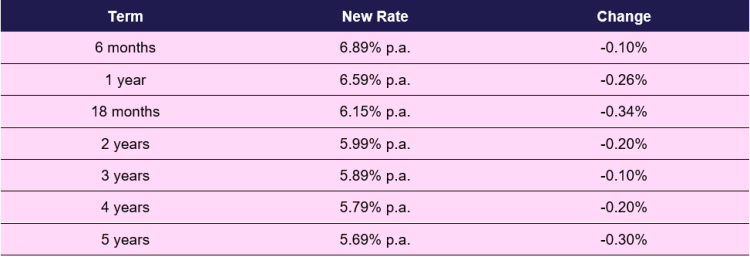

Fixed home loan rates – Special – effective 19 August 2024

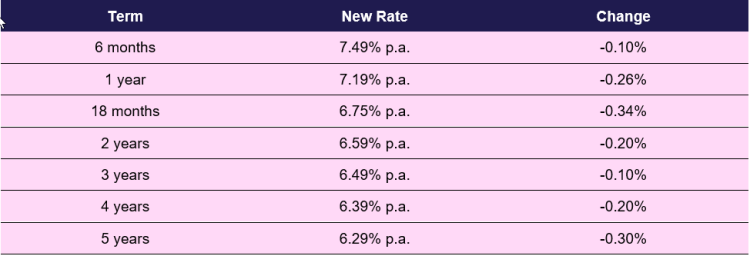

Fixed home loan rates – Standard – effective 19 August 2024

Interest rates are subject to change without notice. Westpac’s terms and conditions and lending and eligibility criteria apply. A low equity margin may apply. For more information please go to www.westpac.co.nz

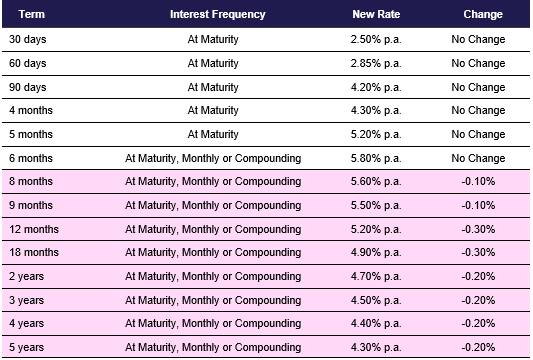

Term Deposits – effective 19 August 2024

Rates are subject to change without notice. Minimum $5,000 deposit. Rates are available for Retail and Business Banking customers holding up to $5,000,000 total deposits, either solely or jointly with Westpac NZ (including PIE investments). For rates applicable to amounts in excess of $5,000,000, please contact us. Rates are not available to Financial Institutions. Other T&Cs apply, see westpac.co.nz for details and a copy of the term sheet for Westpac Term Deposits.

Compounding interest: For terms six months or longer, interest can be compounded quarterly.