Latest scams & alerts.

To help better protect you, this page provides information on some of the scams that are circulating at the moment.

April 2024.

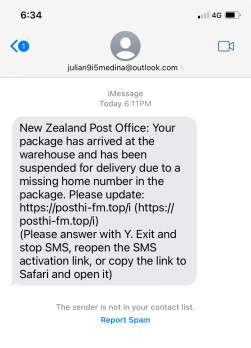

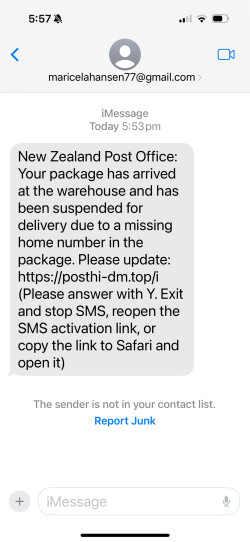

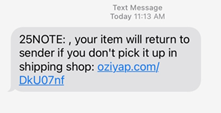

NZ Post phishing scam

Parcel delivery text phishing scams continue. The latest message pretending to be from New Zealand Post says that a package has arrived at their warehouse and has been suspended for delivery due to a missing home number.

The message asks recipients to respond and follow a link provided. These links direct people to malicious sites that will either infect their device or obtain personal details to compromise their bank accounts.

These messages are coming from email addresses rather than phone numbers.

What to do

- If you receive a text message like this, do not respond or follow any links. The sender and the brand may vary but the intent of the message is the same.

- Send a screenshot of the message to phishing@westpac.co.nz.

- Forward the message to the DIA on 7726. The DIA will reply asking for the phone number/ email address the SMS was sent from – send that in a reply. For more information, see the DIA website.

- Once reported, delete the message and block the sender.

- Please be extremely vigilant for any unexpected or suspicious phone calls or text messages.

- Read carefully to understand what is being asked for.

- If you believe you've been targeted by a scam, contact your bank immediately.

- If you think your personal details have been compromised, you can also contact ID Care on 0800 121 068 or 09 884 4440, 10am to 7pm, Monday to Friday.

February 2024.

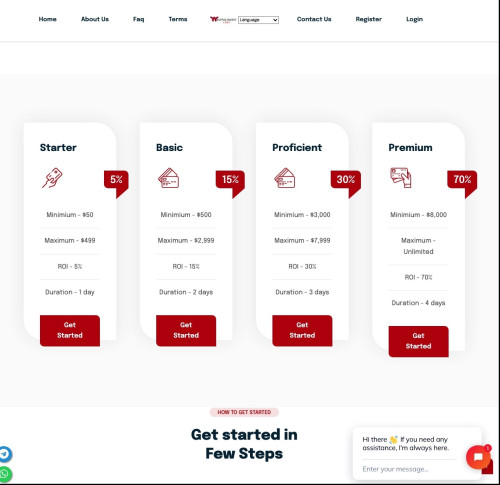

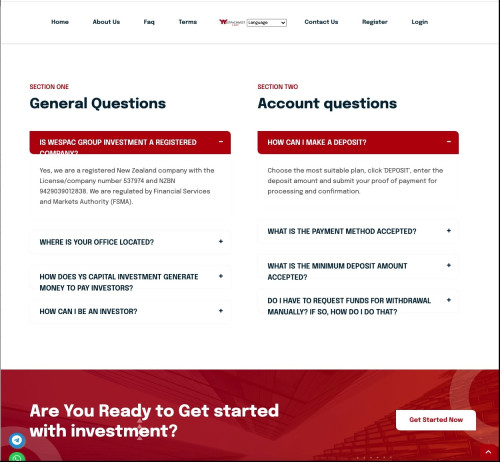

Investment scams

There continue to be sophisticated investment scams using the branding of banks and other financial institutions. These scams can result in large financial losses and in many cases the money can’t be recovered.

Below is an example of a fake Westpac website that scammers set up. They’re pretending to offer investment options to steal people’s money.

What to do?

- You can visit our Kiwisaver and Investments page to find out about the investment options we offer.

- Before investing, contact the bank or financial institution using contact details on their official website to confirm any offers are genuine.

- Seek advice from a qualified financial advisor. Online searches can lead you to fraudulent websites and adverts.

- Avoid engaging with online ads and online brokers or businesses with no presence in New Zealand.

- Take time to consider what you have been asked to do and whether there's anything unusual about the offer.

- Visit our types of scams page to learn more about investment scams and how to avoid them.

- If you think you’ve been scammed, call us immediately on 0800 400 600.

Fake Westpac calls

We are continuing to see a high volume of scam calls to Westpac customers. Scammers are posing as Westpac employees and calling customers pretending to be from Westpac, often our Financial Crime or Fraud team. They may say there’s been fraud on your account and that quick action is needed to secure the funds. But the calls aren’t from us.

Through the phone call, scammers are trying to gain information needed to access customers’ bank accounts or convince customers to make payments. The scammers gain information about people and their banking (often from phishing) prior to the call and use this to trick customers into believing they are genuine Westpac employees.

Some of these calls appear to come from official Westpac phone numbers (or numbers that look similar). They can also come from other domestic or international numbers (often Australia or UK).

What to do:

- Please be extremely vigilant for any unexpected or suspicious phone calls. If you have any doubt, phone us yourself using our official phone number, 0800 400 600.

- If you're calling us after a suspicious phone call, always wait on the phone until we answer, don’t request our call back service. Scammers often call again, and you may think it’s us, but it could be the scammer.

- Don't feel pressured to comply with a request you're not comfortable with. Scammers often spend a long time convincing people to do what they want and may call them repeatedly.

- Carefully read any email and text alerts you receive from us and make sure that you are using that information for its intended purpose only.

- If you believe you've been targeted by a scam, contact us immediately.

- You can also block your Credit or Debit Mastercards through the 'Manage my Cards' button in Westpac One® online banking.

Westpac staff will never ask you for the following:

- We'll never ask you to give us remote access to your computer or phone, or to download software like Anydesk or Team Viewer.

- We'll never ask you to move money to another account to keep it safe or help us catch criminals or hackers.

- We'll never come to your home (or send a courier) to pick up cards or cash.

- We'll never ask you to withdraw cash to keep it safe.

- Under no circumstances would anyone from Westpac ask for your online banking password or PIN. These are your details and shouldn't be shared with anyone.

- We'll never email or text you with a direct link to a page asking you to log into your online banking or provide any personal information.

- We'll never send you an unsolicited message on social media or messaging apps like Whatsapp.

December 2023.

New Westpac branded phishing trend

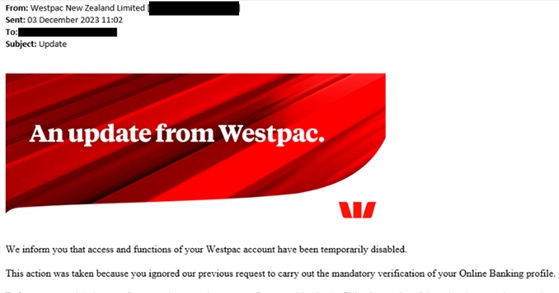

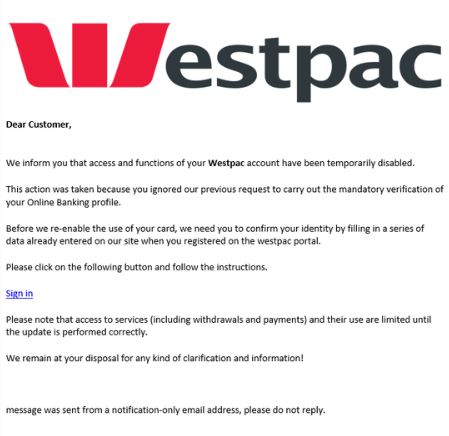

Westpac impersonation ‘phishing’ campaigns are continuing – below is a recent example in an email.

What to do:

Be extremely wary of any emails or text messages claiming to be from Westpac, and never follow a link claiming to take you to log into your Westpac account.

October 2023.

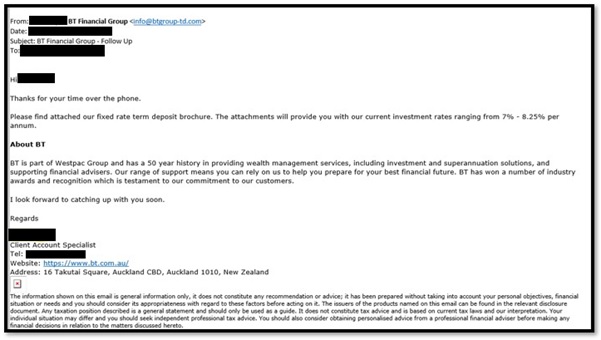

BT themed investment scams

We’re getting a high number of reports of investment scams using branding of well-known financial institutions. Recently, scammers have set up fake BT Financial websites and are sending fraudulent emails claiming to be from BT.

The websites and emails look and sound professional. Once people have registered or expressed interest, they are provided with legitimate looking application forms, prospectus documents and/or other brochures.

They will be asked to provide personal information (including IDs) and to transfer funds. These scams can result in huge financial loss and in many cases the funds are unrecoverable.

What to do:

- BT Funds Management (NZ) Limited (BTNZ) manages all of Westpac's investment funds. You can contact us on 0508 972 254 or from overseas +64 9 375 9978 to confirm whether an investment is legitimate.

- Seek advice from a qualified financial advisor if you’re thinking about investing. Online searches can lead you to fraudulent websites and/or adverts.

- Avoid engaging with online ads and online brokers or businesses with no presence in New Zealand.

- Don’t respond to unsolicited investment offers.

- Take time to consider what you have been asked to do and whether there's anything unusual about this opportunity. For example, being asked to send funds overseas or by unusual payment methods such as cryptocurrency.

- Set up security alerts on Westpac One to keep track of online activity.

- If you ever think you’ve been scammed, call us immediately on 0800 400 600.

September 2023.

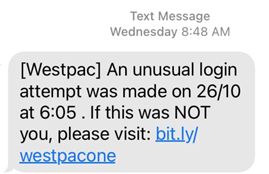

Westpac themed phishing texts

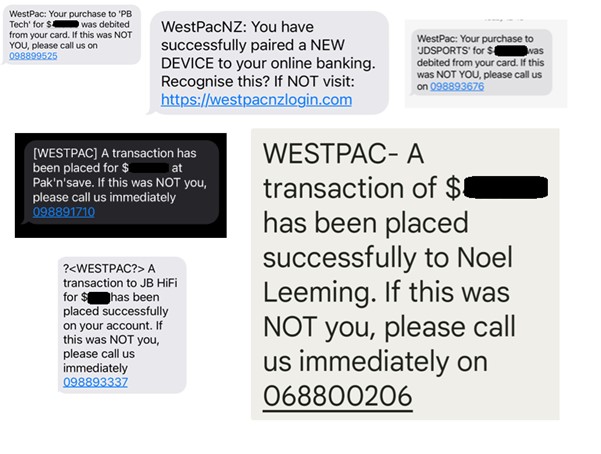

Our Financial Crime team continue to receive reports of phishing texts pretending to be from Westpac.

These messages direct people to malicious websites designed to look like the bank’s real website or advise the recipient to call a number. These sites either infect devices with malware, collect the victim's personal and banking details, or both. Interacting with these text messages can lead to bank impersonation calls and scam attempts.

What to do:

- If you receive a message like this, don’t click on any links or call the number.

- Send a screenshot of the message to phishing@westpac.co.nz

- Forward the message to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website.

- Once reported, delete the message and block the sender.

- If you believe you've been targeted by a scam, contact your bank immediately.

- Please be extremely vigilant for any unexpected or suspicious phone calls or text messages.

- Listen/ read carefully to understand what is being asked for.

- If they claim to be from Westpac, hang up and call us back on 0800 400 600.

- When phoning, don’t request a call back as scammers often call again.

- Never allow remote access to your devices or download software at the request of a caller.

- Never share your online banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

- Visit the CERT website for tips on identifying phishing attempts.

July 2023.

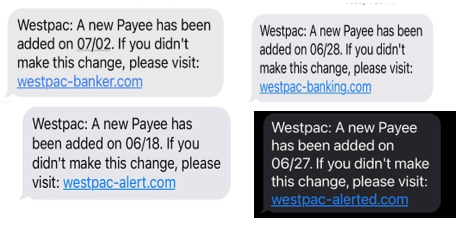

Westpac themed phishing texts: new payee added

Our Financial Crime team has received numerous reports of a new Westpac branded phishing text advising that a new payee has been added. The text messages are coming from New Zealand mobile numbers.

These messages direct people to malicious websites designed to look like the bank’s real website. These sites either infect devices with malware, collect the victim's personal and banking details, or both. Interacting with this text message has led to bank impersonation calls and scam attempts.

What to do:

- If you receive a message like this, don’t click on any links.

- Send a screenshot of the message to phishing@westpac.co.nz

- Forward the message to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website.

- Once reported, delete the message and block the sender.

- If you believe you've been targeted by a scam, contact your bank immediately.

- Please be extremely vigilant for any unexpected or suspicious phone calls or text messages.

- Listen/ read carefully to understand what is being asked for.

- If they claim to be from Westpac, hang up and call us back on 0800 400 600.

- When phoning, don’t request a call back as scammers often call again.

- Never allow remote access to your devices or download software at the request of a caller.

- Never share your online banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

- Visit the CERT website for tips on identifying phishing attempts.

June 2023.

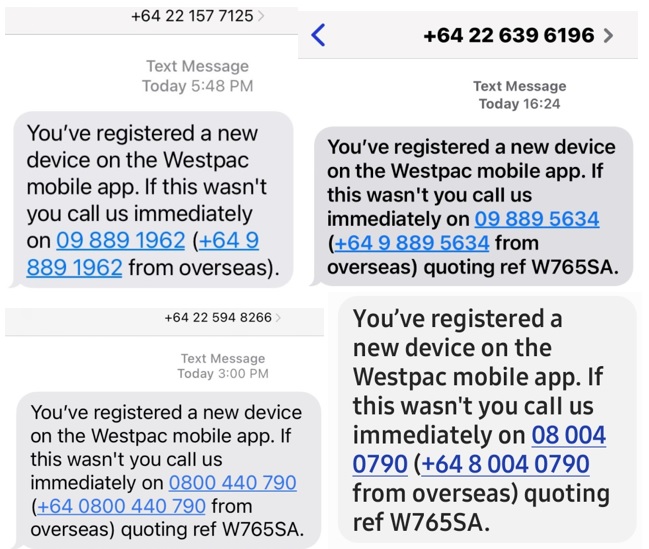

Westpac themed phishing texts

Our Financial Crime team has received numerous reports of a widespread text phishing campaign.

The messages say ‘You have registered a new device on the Westpac mobile app. If this wasn’t you call us immediately’ with a landline or an 0800 number.

This type of phishing is different as it does not include a URL link to click on and is asking people to call ‘Westpac’ on a New Zealand based number. If people were to call these numbers, they will likely get an individual impersonating Westpac staff, trying to obtain information or authentication codes in an attempt to access their accounts.

The text messages are coming from New Zealand mobile numbers. The sender and the numbers provided to call vary but the intent of the message is the same.

What to do:

- Forward phishing emails and SMS messages to phishing@westpac.co.nz

- Forward phishing SMS messages to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website

- Once reported, delete the message and block the sender

- If you believe you've been targeted by a scam, contact your bank immediately

- Visit the CERT website for tips on identifying phishing attempts.

BT themed investment scams

We’re getting a high number of reports of investment scams using branding of well known financial institutions. Recently, scammers have set up fake BT Financial websites and are sending fraudulent emails claiming to be from BT.

The websites and emails look and sound professional. Once people have registered or expressed interest, they are provided with legitimate looking application forms and brochures.

They will be asked to provide personal information (including IDs) and to transfer funds. These scams can result in huge financial loss and in many cases the funds are unrecoverable.

What to do:

- BT Funds Management (NZ) Limited (BTNZ) manages all of Westpac's investment funds. You can contact us on 0508 972 254 or from overseas +64 9 375 9978 to confirm whether an investment is legitimate.

- Seek advice from a qualified financial advisor if you’re thinking about investing. Online searches can lead you to fraudulent websites and/or adverts.

- Avoid engaging with online ads and online brokers or businesses with no presence in New Zealand.

- Don’t respond to unsolicited investment offers.

- Take time to consider what you have been asked to do and whether there's anything unusual about this opportunity. For example, being asked to send funds overseas or by unusual payment methods such as cryptocurrency.

- Set up security alerts on Westpac One to keep track of online activity.

- If you ever think you’ve been scammed, call us immediately on 0800 400 600.

See more information about investment scams.

May 2023.

Investment scams

Investment scams are on the rise. Many start with a cold call, an online ad or a message on social media. Scam websites can also show up when you search for investment opportunities online. This will lead to someone contacting you claiming to be a broker or account manager who’s eager to help you invest. Later, when you try to withdraw your investment you find you can’t and may even be asked to pay more to access your funds.

These scams can result in huge financial loss and in many cases the funds are unrecoverable. Watch out for scams involving cryptocurrency and fake term deposits or bonds from scammers pretending to be from legitimate financial service providers (such as banks).

What to do:

- Contact the financial institution offering the investment using a number on their official website to check it’s legitimate

- Consider if there’s anything suspicious about what they’re offering – they often promise a high return for what seems like low risk

- Seek advice from a qualified financial advisor

- Don’t respond to unsolicited investment offers

- If you ever think you’ve been scammed, call us immediately on 0800 400 600.

Sextortion

Sextortion involves scammers reaching out and forming relationships with people on social media platforms like Snapchat, Discord or Wizz and later moving the conversation onto other platforms that display friends and family profile details.

Scammers use specific profiles so they appear to be around the same age as the victim and of the opposite sex. They often begin by reaching out for a friend request and then move the conversation to a platform such as Instagram where they can view the victim’s contacts.

They then send the victim an intimate image and encourage them to take part in video chats or sharing their own intimate pictures. Screenshots are taken of intimate images and videos are recorded.

As soon as an intimate image or video has been shared the victim is told they have been recorded and that the recording or pictures will be shared online or with their friends and family unless a ransom is paid immediately.

The scammers apply pressure to the victim and tell them the image will be deleted as soon as they pay. However, this is not the case. They will keep demanding more money.

What to do:

- Cease all contact with the scammer. Save or screenshot any online chats for evidence, then block the scammer’s profile.

- Don’t pay them or share any more images.

- Contact the correct authorities – by reporting to a local police station or online 105 Police Non-Emergency or to Netsafe

- If you have a copy of the private images or video you are being threatened with, you can use a free service to get them removed.

- Images or videos of people under 18 years of age: Take It Down

- Images or videos of people aged 18 and over: Stop NCII

- It might be a good idea to deactivate social media profiles for a while or set social media account privacy settings to their highest level.

- For confidential support, victims can talk to:

For more information, see our REDnews article Sextortion: The damaging new scam targeting teenagers.

Threat and penalty scams

Scammers are contacting people and claiming to be from Police, another government agency or business and using threats to get money and personal information. Recently they have been posing as employees from the Chinese Embassy and/or Chinese or Hong Kong Police.

Usually, they accuse people of a crime or of having unpaid fines or fees and demand a payment. They’ll threaten arrest, visa cancellation or deportation if the victim doesn’t comply.

Scammers even dress up in police uniforms and provide fake arrest warrants or other documents to convince people.

What to do:

- Be wary of threatening calls, messages or emails. Police will never contact you this way and ask you to send money.

- Contact the organisation using the contact details on their official website to confirm whether a request is genuine.

- Don’t feel pressured to comply with a request urgently. Any genuine business or government agency will give you time to pay invoices, bills or fees.

- Always be honest about what happened with your bank so that we can assist you and help keep your money safe.

April 2023.

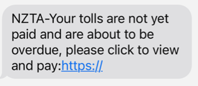

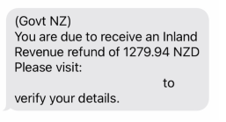

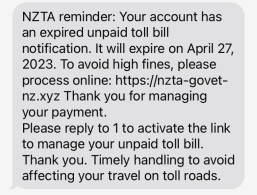

NZTA / Toll phishing SMS and emails

Our Financial Crime team are seeing a significant phishing campaign, involving both SMS and email messages.

The most reported varieties impersonate the NZTA and claim the user needs to pay tolls or renew their vehicle registration. Other messages impersonating IRD or other government departments are also being sent.

These messages direct people to malicious websites designed to look like the real government website. These sites either infect devices with malware, collect victim's personal and banking details, or both.

The scammers then compromise the victim's accounts and conduct fraudulent transactions. This type of phishing is not new, but the current campaign is more extensive than we have seen recently.

What to do:

- Do not click on or open any links in SMS or emails unless you are completely certain that both the sender and the link are legitimate. If you are unsure, do not open the link

- If you have recently travelled on toll roads, visit the legitimate NZTA website to pay your toll

- Forward phishing emails and SMS messages to phishing@westpac.co.nz

- Forward phishing SMS messages to the DIA on 7726. The DIA will reply asking for the phone number the SMS was sent from – send that in a reply. For more information, see the DIA website

- Delete the message and block the sender

- If you believe you've been targeted by a scam, contact your bank immediately

- Visit the CERT website for tips on identifying phishing attempts.

February 2023.

Phishing emails

Our Financial Crime team are seeing multiple instances of Westpac branded phishing emails informing people that their accounts have been disabled. These are scam emails and embedded links go to fake websites used to steal customers' personal and banking information.

What to do:

- If your receive an email like this, don’t click on any links, respond or call any numbers provided on the email.

- Send it to phishing@westpac.co.nz and delete it.

- Always log in to online banking through the official website or app. We won’t ask you to click on links in texts or emails to log into online banking, provide login details, passwords, PINs or any personal information.

- Please be extremely vigilant for any unexpected or suspicious emails, phone calls or text messages.

- Never share your online banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

- If you believe you've been targeted by a scam, contact your bank immediately.

Fake Westpac calls

Our Financial Crime team have had reports of customers receiving calls from scammers posing as Westpac employees.

Some of the calls appear to come from an official Westpac phone number, however the calls are not from Westpac. Through the phone call, scammers are trying to gain information needed to access the customers’ bank accounts.

What to do:

- Please be extremely vigilant for any unexpected or suspicious phone calls.

- Listen carefully to what is being asked for.

- If in doubt, end the call.

- If they claimed to be from Westpac, call us back on 0800 400 600.

- When phoning, don’t request a call back as scammers often call again.

- Never allow remote access to your devices or download software at the request of a caller.

- Never share your online banking passwords, phone banking or card PINs. Westpac will never ask for them.

- Take care when providing verification codes, scammers are using these to authorise fraudulent payments.

- If you believe you've been targeted by a scam, contact your bank immediately.

Flood-related scams

Scammers take advantage of current events to steal money and bank details. Our Financial Crime team expect to see flood-related scams in the next few days so please be wary of requests for your money or details.

What to do:

- Avoid clicking on links in emails or text messages unless you can confirm they are genuine – Westpac will not ask you to click on links to resolve issues with your accounts.

- Be vigilant for any unsolicited or unusual calls, texts or emails from your bank, insurance company or another business or government agency.

- If you receive a call that you are unsure about, hang up and call the organisation back on their official number.

- Only use well-established and reputable fundraising platforms or official charities to make donations.

January 2023

Phishing texts

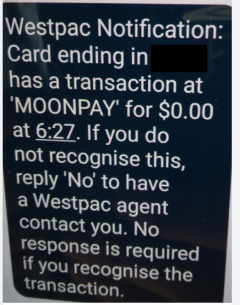

Our Financial Crime teams are seeing multiple instances of a new Westpac branded phishing text that reads:

"Westpac Notification. Card ending in XXXX has a transaction at 'MOONPAY' for $0.00 at 6:27. If you do not recognise this, reply 'No' to have a Westpac agent contact you. No response is required if you recognize the transaction."

Interacting with this text message leads to a bank impersonation call and scam attempts.

December 2022.

Christmas scams

Scammers love Christmas. You may be asked to pay for online goods that are never delivered. Sellers are also being duped with payments that never arrive.

A lot of parcel delivery phishing happens over Christmas. It starts with a false parcel text. Inside is a link to track the delivery, or to pay a fee. But the link leads to a site designed to steal credit card details or install viruses.

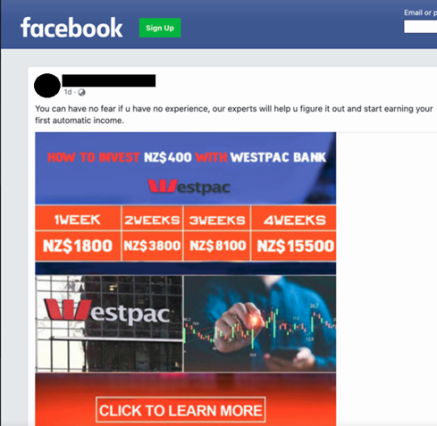

Investment scam

We’ve been alerted to a Facebook ad that uses our name and branding to advertise massive returns on small investments. This is a scam – please do not click any links or interact with the account. Remember – if it looks too good to be true, it probably is.

November 2022.

Parcel delivery phishing

Parcel delivery text phishing scams continue. The text contains information about a parcel that is out for delivery or a delivery that has been missed. The text contains a web link to track or reschedule the delivery. Clicking the link will lead to a site designed to steal credit card details or install viruses.

October 2022.

Phishing texts

Our Financial Crime team continues to receive reports of phishing texts claiming to be from Westpac. The embedded links go to fake websites, used to steal customers' credit card details and online banking credentials.

August 2022.

Fake Westpac calls

The Financial Crime team have had reports of customers receiving calls from scammers posing as Westpac employees. Some of the calls appear to come from an official Westpac phone number, however the calls are not from Westpac.

Through the phone call, scammers are trying to gain information needed to access the victim’s bank accounts.

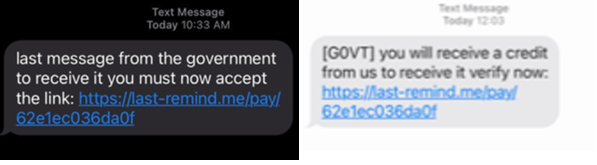

Cost of Living Payment scams

Our Fraud team is seeing several examples of text message scams based on the Government's Cost of Living payment. Embedded web links are used to steal personal information and banking credentials.

July 2022.

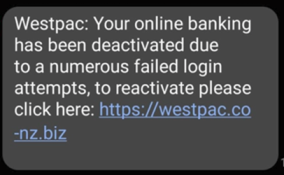

Phishing texts

The Financial Crime team have had reports of phishing texts stating that online banking has been deactivated. The embedded web link goes to a fake website, used to steal customers’ credit card details and online banking credentials.

Cryptocurrency scams

We've seen an increase in cryptocurrency investment scams. Scammers will often try and convince someone to pay large amounts to "invest" with the promise of high returns. They’ll often pitch these fake investment opportunities as being low risk as well. The victim may not know that they’ve been targeted by a scam until some time has passed, for example when they try to withdraw their funds.

Scammers will often claim to be financial advisors or investment experts, or claim to have made large profits investing in the scheme themselves. They may even create legitimate looking fake websites and prospectus documents or use celebrities' names and pictures to endorse their schemes.

May 2022.

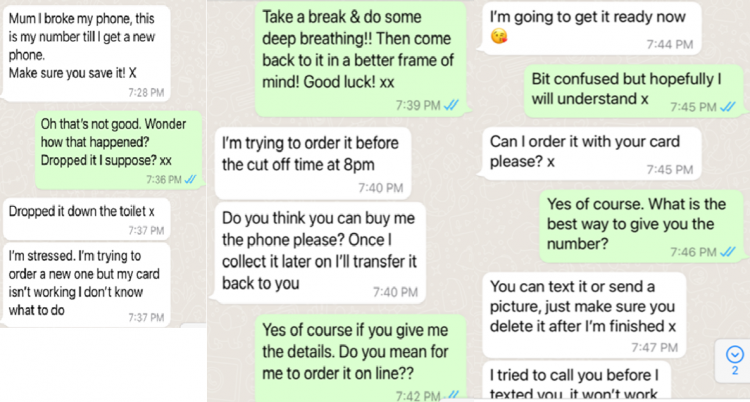

WhatsApp scam messages

We've received several reports of WhatsApp scam messages. The messages are targeting parents. The scammer, who is pretending to be their child, claims they have recently lost or damaged their phone and is messaging from a new phone number. They ask for help buying a new phone by requesting credit card details.

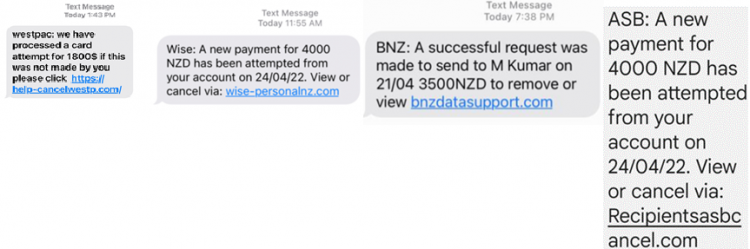

April 2022.

Phishing texts

The Financial Crime team have had reports of similar phishing texts relating to Wise, BNZ and ASB. The embedded web link goes to a fake website, used to steal customers' credit card details and online banking credentials. The texts are coming from different Australian mobile numbers.

January 2022.

Threat and penalty scams

The Financial Crime team are observing an increase in threat and penalty scams. Scammers are contacting people and claiming to be from the Police, another government agency, or a business, and threatening to take severe action or fine them unless they make payments or give out personal information.

There have been recent reports of scammers making contact by video call, posing as police officers in China and accusing the recipient of a crime. They threaten them with harm, arrest or legal action if they don't make payments to an overseas account.

Special deals

The Financial Crime team have identified several card compromises that appear to be linked to special deals being advertised on Facebook. Customers are responding to online ads offering these items for really low prices (e.g. $3 for a Smeg kettle, $2.99 for an iPad). Often they're asked to complete a survey and will be asked for personal and/or credit card details.

Scam calls targeting law firms

The Financial Crime team are aware of scam calls targeting law firms. The caller contacts the law firm claiming to be a Westpac staff member from the International Payments team and requests to speak with the firm’s bank account signatory. They claim funds have been fraudulently withdrawn from the firm’s account and that a block has been placed on the account. They ask the signatory to sign some forms to enable the block to be removed and the fraudulent payment to be reversed.

Westpac investment scam

We are aware of a sophisticated investment scam targeting customers which includes a fake Westpac Investment Prospectus.

Customers may find themselves targeted by these scammers when they do an internet search for term deposits or investments, and then click on fraudulent ad links that appear in the search results.

Report a scam.

Email us

If you believe you have received a suspicious email, you can forward it to us.

Report to other agencies

Once you have spoken to us, you should report scams to other agencies so that they can take steps to prevent other people being targeted by them and losing money.

- Report online fraud and scams to Netsafe

- Report cybersecurity issues to CERT NZ

- Report investment scams to The Financial Markets Authority

- If you've been impacted by a scam or fraud, IDCARE provide specialist aftercare support.