Split home loan.

Splitting your home loan between a floating rate and a fixed rate gives you flexibility as well as certainty.

Benefits.

- Flexibility to pay off the floating portion as fast as you like with no prepayment costs.

- Have peace of mind that repayments for your fixed portion won't change for the fixed period you have chosen.

- Select different terms for the fixed portion, from six months to five years.

How it works.

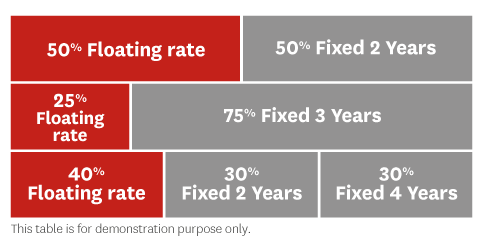

Splitting your home loan between floating and fixed interest rates means you can enjoy the benefits of both. The floating portion gives the flexibility to make lump sum payments with no prepayment costs, while the fixed part helps to spread risk if interest rates go up or down. Here are some different options for splitting your loan.

Split home loan calculator.

Get in touch.

Meet with an expert

Our Home Loan Experts can come to you, when it suits you best.

Apply online.

Existing customers can apply for a home loan via Westpac One® online banking.

Things you should know.

Westpac's home loan lending criteria, terms and conditions apply. A low equity margin may apply.

Documents and fees

See the detailed terms and conditions and fees for our Choices Fixed, Choices Floating and Choices Everyday Home Loans:

- Choices Home Loan Summary - Sample (fixed and floating)

- Choices Everyday Home Loan Summary - Sample

- Choices Home Loan Terms and Conditions

- Choices Everyday Home Loan Terms and Conditions

- Transaction and Service Fees

- Westpac General Terms and Conditions

View terms and conditions for all our home lending products here.